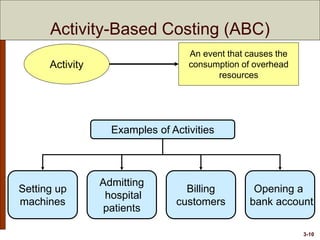

Activities Is the First Step in Applying Activity-based Costing.

It divides the overheads into different cost pools and then allocates them. It identifies the activities in the organization such as the purchase of material is an activity of purchase requisition follow up from the suppliers of the delivery of the product is also an.

Chapter 7 Activity Based Costing A Tool To Aid Decision Making Flashcards Quizlet

Seuring 2002a presents a three step approach to activity-based costing in supply chains.

. Activity Based Costing Steps. Be sure to include both direct expenses such as materials as well as. Estimate a total cost for each of the activities identified.

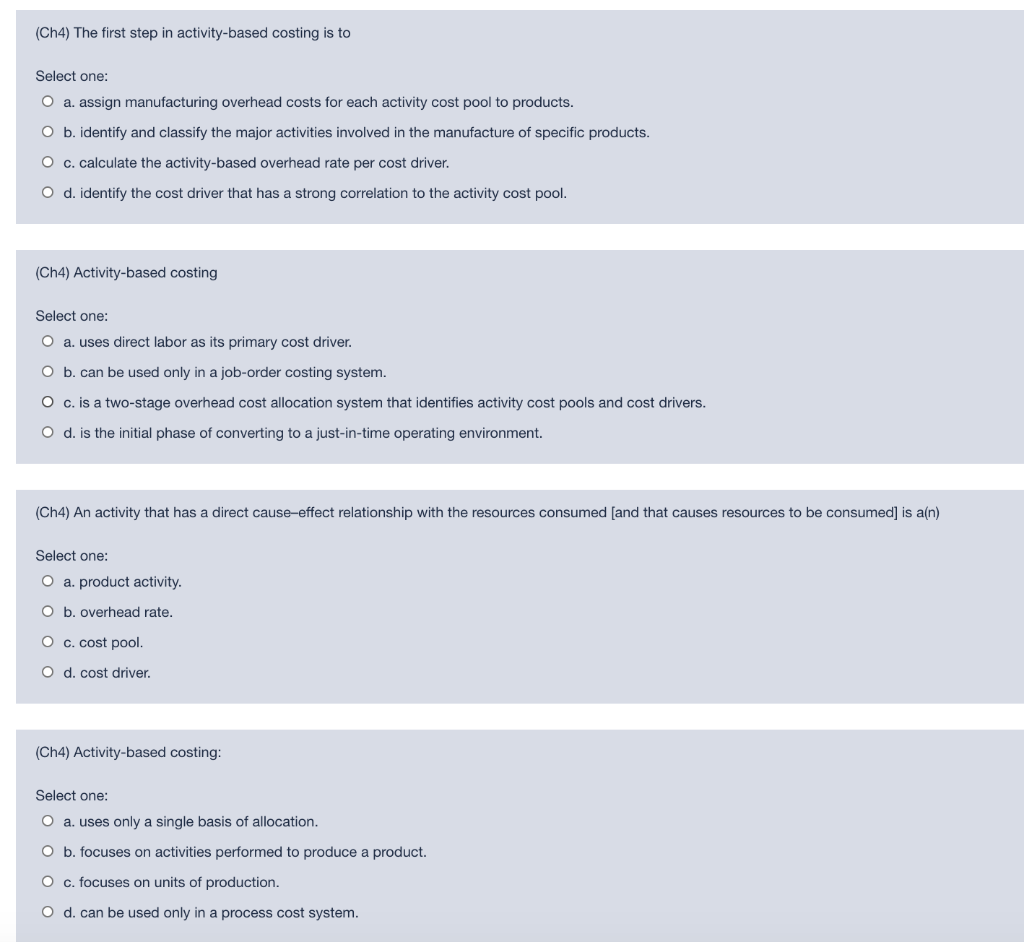

The first step in applying the activity-based costing method is a. Identifying the activities that consume resources d. Identify and classify the activities involved in the ma and allocate overhead to cost pools.

Activities causing overheads or cost drivers are identified. The first step is to identify and measure all of the costs incurred in carrying out specific activities. It was then at the dawn of the 1980s that 2.

The first step in using activity-based costing is to list all of the activities necessary in order to create your product. ____ Unit Batch Product activities are performed on each product unit. What is the second step in activity-based costing.

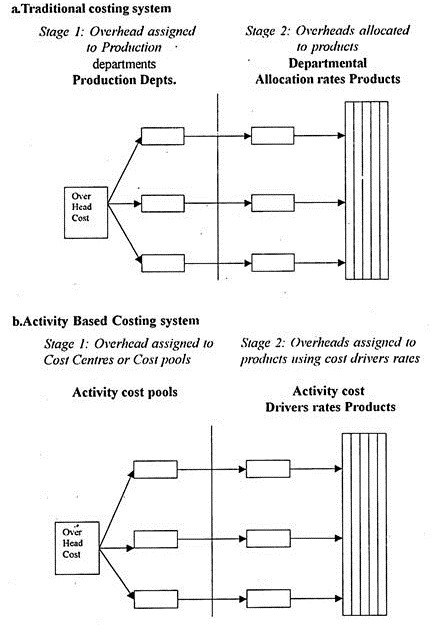

Identifying the cost drivers b. Cost hierarchy is a framework that classifies activities based the ease at which they are traceable to a product. In activity-based costing activities in each cost pool should be similar dissimilar.

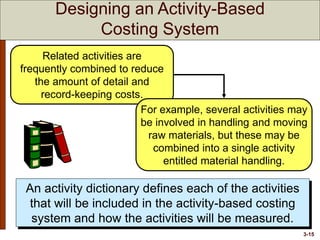

Identifying the major activities taking place in and enabling accurate and causal cost allocati- an organization. Activity-based costing takes into account the activities needed to complete products including the associated costs of each activity. Applying Activity-Based Costing 1 Identify the activities involved in the manufacturing of a product The first step is to identify the activities involved in.

Second The departmental overhead rate method uses a four-step process to allocate cost object. When applying activity-based costing the first step is to identify the activities. Identifying AssigningTracing activities is the first step in applying activity-based costing.

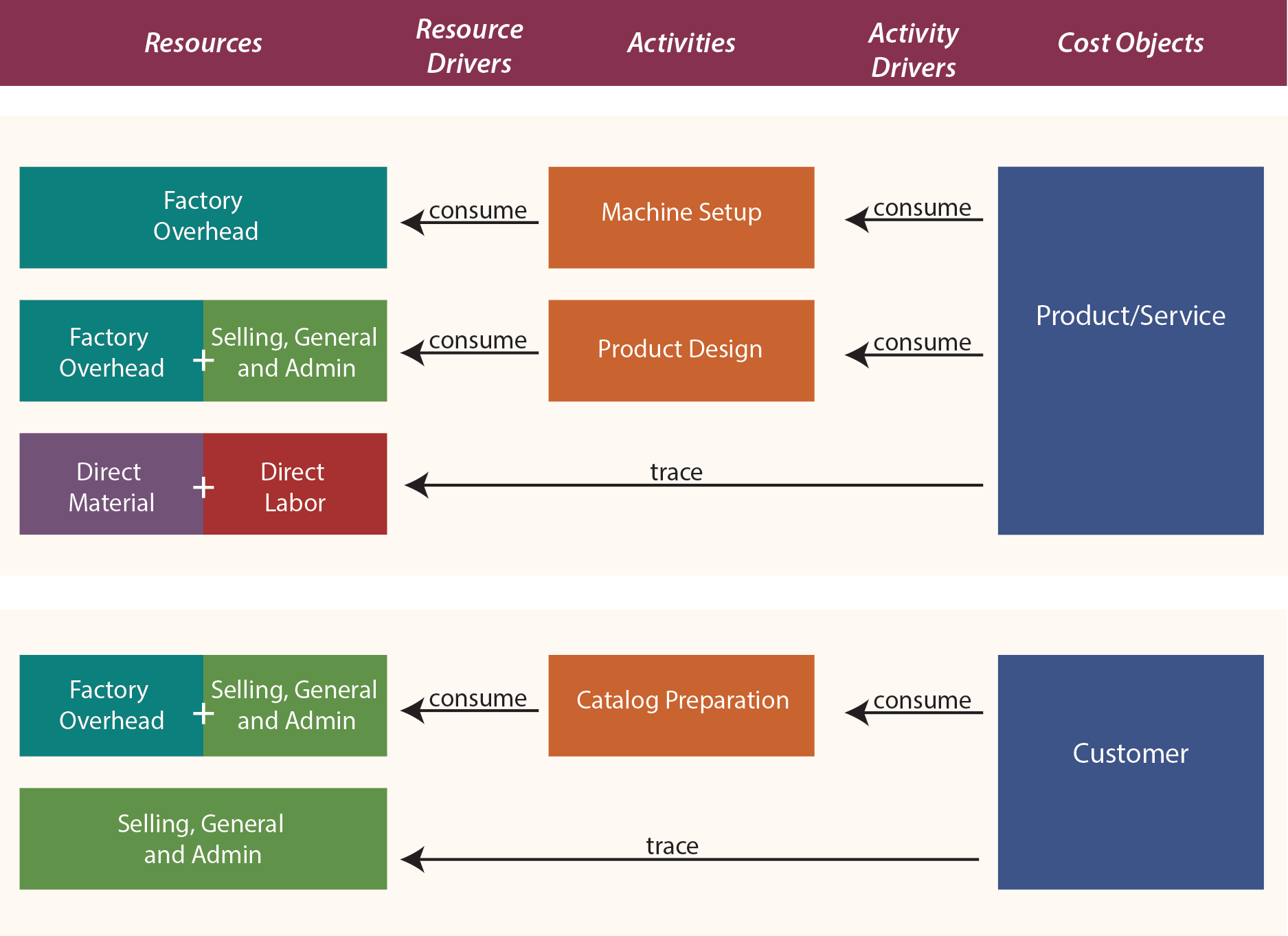

Application of the cost of each activity to products based on its activity usage by the product. It is a system which focuses on activities performed to produce products. Identify the cost driver that has a strong correlation to.

Computing a cost rate per cost driver c. The first step in using activity-based costing is to list all of the activities necessary in order to create your product. The system can be employed for the targeted reduction of overhead costs.

Compute overhead allocation rates for each activity. Match the activity to the most appropriate cost driver. According to Dansby and Lawrence In ABC costs are not initially traced to departments.

The first step in activity-based costing is to a. Assigning costs to cost poolscost centers the Activity-Based Costing ABC method came for each activity. Activities causing overhead include all of the following.

Activity-based costing ABC is a methodology for more precisely allocating overhead costs by assigning them to activities. The levels are a unit level. About being quickly adopted by enterprises of 3.

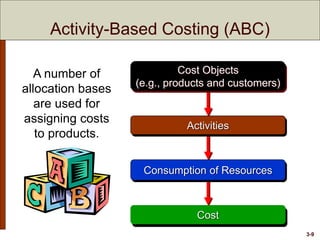

Instead costs are first traced to activities and then to products. Compute a cost-driver rate for each activity based on a cost allocation base that has a causal link to the cost of the activity. ____ Identifying Assigning Tracing activities is the first step in applying activity-based costing.

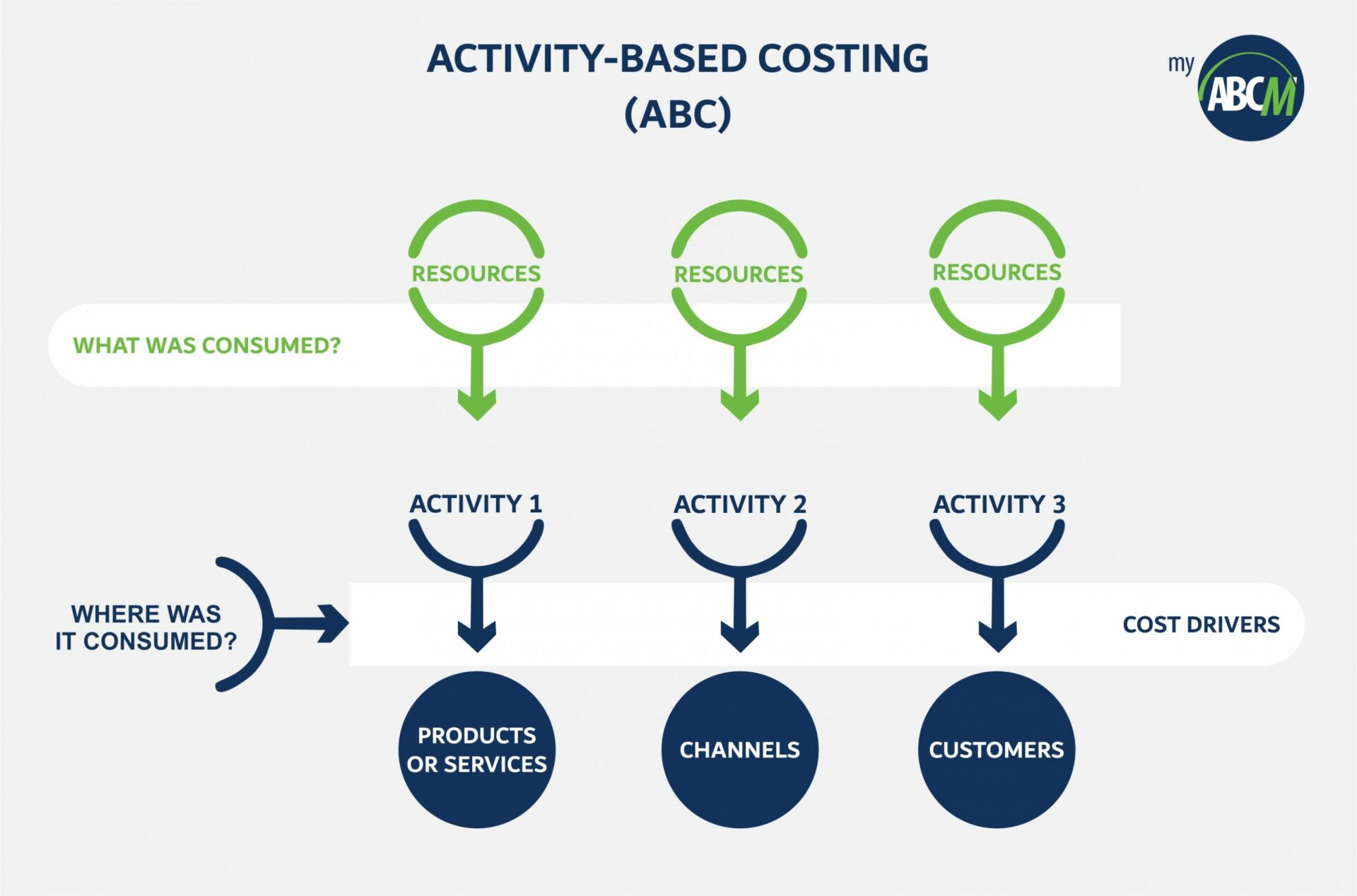

ABC system assumes that activities that are responsible for the incurrence of costs and products create the demand for activities. You will need to determine. What is Activity-Based Costing.

Select all correct answers. Who carries out the work and how much time they devote to it. The first step in activity-based costing involves identifying activities and classifying them according to the cost hierarchy.

Computing the cost driver rates is the third step in the application of activity-based costing. Identify activities and the overhead costs they cause. Trace overhead costs to activity cost pools.

Identify and classify all of the activities in the value chain related to the production of the product. Activity Based Costing is being introduced to solve the costing problems associated with the traditional costing method. Activity-Based Costing ABC is one in which costs are first identified to activities and then to the products.

Reflecting thoughts on transaction cost economics and based on the insights of LaLonde and Pohlen 1996. Each category of resource materials labour and equipment needs to analysed and assigned to the cost pool for a particular activity. ABC creates a link between activities and products by assigning a cost of activities to products based on an individual product.

The first step inter-company integration of process modelling describes a top-down process analysis based on the SCOR model Stewart 1997. Compute the activity-based overhead rate per cost driv c. Use the activity overhead rates to assign overhead costs to cost objects products.

_____ activities is the first step in applying activity based costing activity cost driver in activity based costing the factor which drives costs and causes in the pool to be incurred is a _______. Assigning activities and their overhead costs to activity cost pools is the ____ first second third fourth step in activity-based costing. Discover the seven steps of activity-based costing and learn.

Assigning costs to products. Once costs are assigned to activities the costs can be assigned to the cost objects that use those activities. Assign overhead costs to products using overhead cost pool b.

_____ activities is the first step in applying activity based costing activity cost driver in activity based costing the factor which drives costs and causes in the pool to be incurred is a _____.

Applying The Activity Based Costing Abc Model Magnimetrics

Systems Design Activity Based Costing Ppt Download

Acc Mgt Noreen03 Systems Design Activity Based Costing

Steps In Activity Based Costing Wikieducator

Activity Based Costing Abc Versus Traditional Cost Accounting Tca Download Scientific Diagram

Activity Based Costing Ppt Download

Activity Based Costing Structure Kaplan Cooper 1998 Download Scientific Diagram

Activity Based Costing Meaning Definitions Features Steps Limitations Benefits Uses And Examples

Activity Based Costing Principlesofaccounting Com

Activity Based Costing Cam I Download Scientific Diagram

Solved Ch4 The First Step In Activity Based Costing Is To Chegg Com

Acc Mgt Noreen03 Systems Design Activity Based Costing

Acc Mgt Noreen03 Systems Design Activity Based Costing

Steps For Designing An Activity Based Costing Abc System Modified Download Scientific Diagram

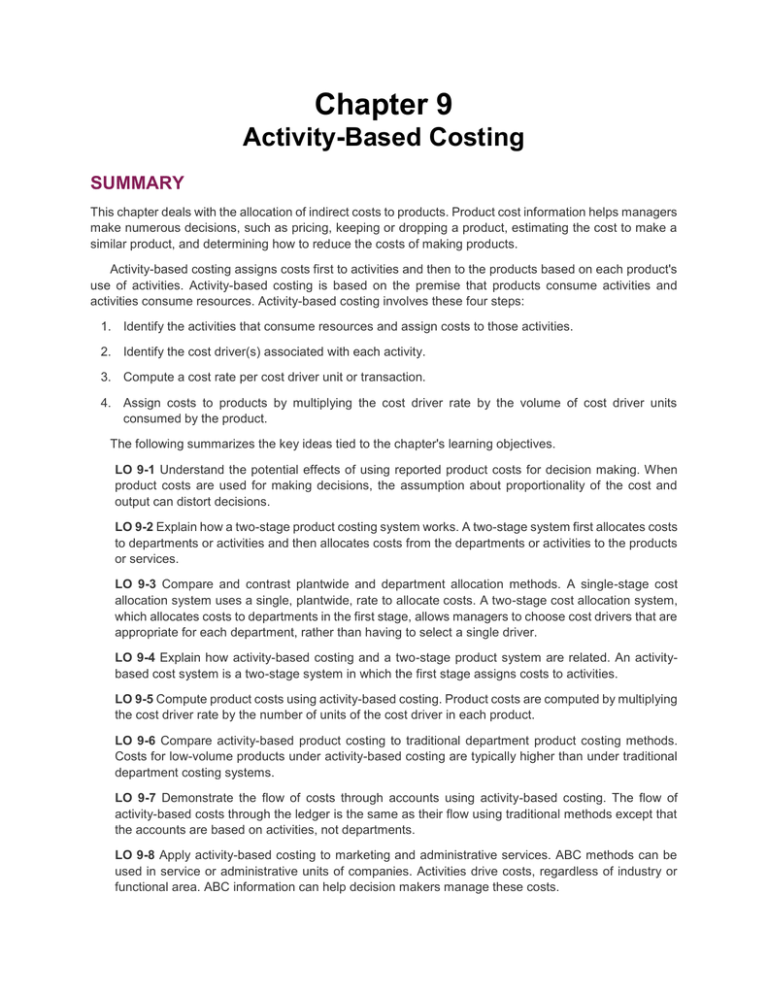

Chapter 9 Activity Based Costing Summary

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

Comments

Post a Comment